NEWS

NEWS2026 UK Energy Storage Market Analysis

Nov. 7 2025, Published 1:23 a.m. ET

▶ Introduction

Explore the UK BESS market. Our 2026 guide shows new chances from the 2030 plan. We make understanding BESS revenue streams effortless. UK is one of Europe's most attractive countries for Battery Energy Storage System (BESS) investment. It currently has the highest installed grid-scale BESS capacity in Europe and offers diverse revenue streams, strongly supported by the government and grid operators.

▶ Executive Summary

The UK is one of Europe's most attractive countries for Battery Energy Storage System (BESS) investment. It currently has the highest installed grid-scale BESS capacity in Europe and offers diverse revenue streams, strongly supported by the government and grid operators.

The UK government has set an ambitious target: to achieve clean energy production equal to its consumption by 2030. This goal drives significant growth in renewable energy and requires increased flexibility in the energy system, primarily through BESS.

A key question remains whether market conditions are sufficiently attractive to secure the BESS capacity required by the system.

Due to the further increase in renewable energy generation capacity, reforms to the balancing mechanism, and price erosion in frequency services, energy arbitrage is set to play an increasingly important role in the BESS revenue stack.

Despite existing uncertainties, the UK BESS market, driven by government plans and market data, still offers significant opportunities for growth and innovation. Investors should stay informed, be adaptable, and seek partnerships to navigate potential challenges.

▶ I. The UK Leads the European Battery Energy Storage System Market

We identify the UK as one of the most attractive European countries for Battery Energy Storage System (BESS) investment. The UK currently holds the highest grid-scale BESS installed capacity, offers the most diverse revenue streams, and receives strong support from the government and grid operators for increasing BESS capacity.

The UK government has formulated ambitious plans aimed at reforming the energy sector and building a clean and reliable system. In December 2024, the newly appointed Labour government released the "Clean Power 2030 Action Plan," setting a target for the UK to produce at least as much clean electricity as it consumes by 2030. Achieving this goal will require a substantial increase in renewable energy sources such as solar and wind. This, in turn, requires greater flexibility in the UK's energy system—for example, in the form of battery energy storage. The UK is a global leader in grid-scale BESS deployment and one of the first countries to actively pursue BESS investment. Due to limited interconnection capacity and a heavy reliance on wind power, the UK requires BESS to ensure the stability of its electricity system.

▶ II. Clean Power 2030 Action Plan: Opportunities for BESS

The UK's electricity system is rapidly evolving. In 2005, most electricity was generated from coal, natural gas, and nuclear power (see Fig 1). In the same year, wind and solar provided less than 1% of the UK's electricity. Fast forward to 2025, wind and solar now produce close to half of the UK's electricity, while the last coal-fired power plant has just closed.

Fig 1: UK Electricity Generation by Source, 2005–2050 — Source: BloombergNEF, RaboResearch 2025

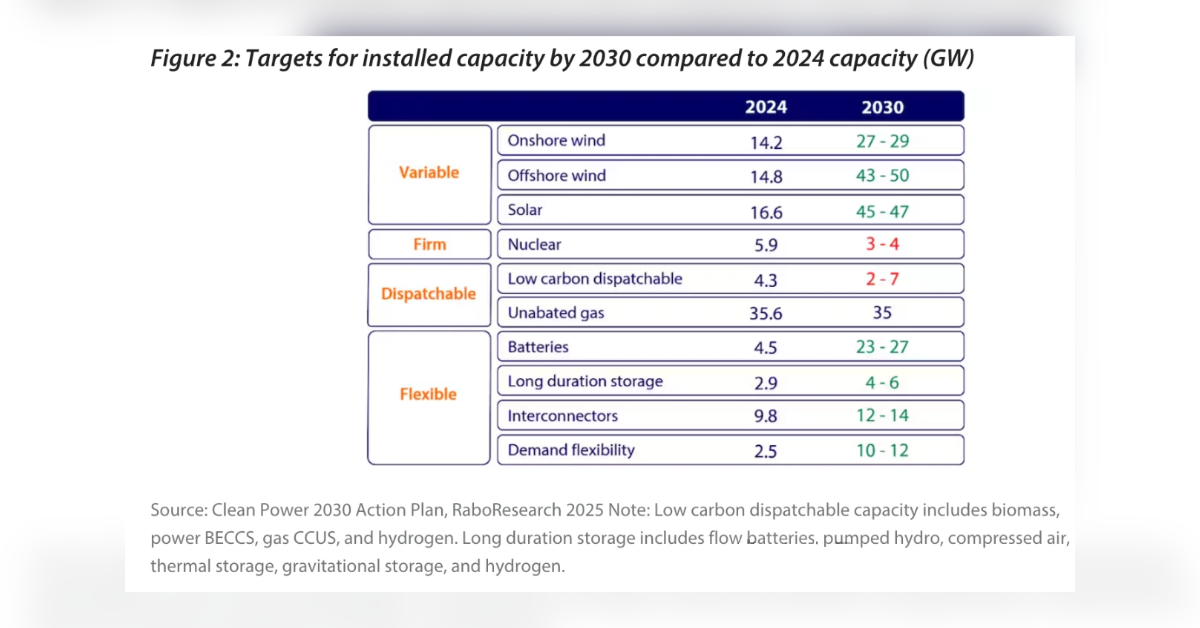

In the coming decades, renewable energy generation is expected to grow to 80% of electricity supply. This vision is supported by the government's latest targets in the "Clean Power 2030 Action Plan" (see Fig 2). According to the plan, installed capacity for variable renewable energy generation will increase significantly, while stable and dispatchable capacity will largely remain the same. A substantial amount of additional flexible sources will be needed to accommodate the higher variability in the generation mix.

Fig 2: 2030 Installed Capacity Targets (GW) Compared to 2024 Capacity (Source: Clean Power 2030 Action Plan, RaboResearch 2025)

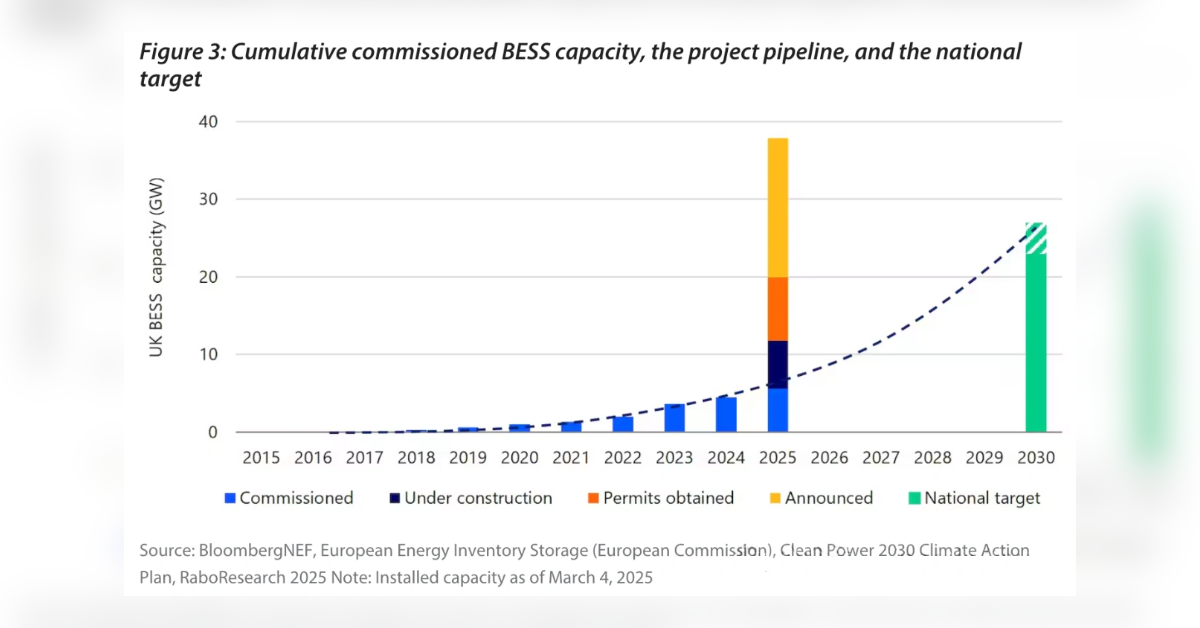

Batteries are expected to play the largest role in providing flexibility to the UK grid. The "Clean Power 2030 Action Plan" projects that BESS installed capacity will increase sixfold from 4.5 GW in 2024 to between 23 GW and 27 GW by 2030. This anticipated capacity significantly exceeds the 14–16 GW expectation earlier reported based on BloombergNEF scenarios. Current installation plans (see Fig 3) indicate that achieving the national target is possible. According to the European Energy Storage Repository (European Commission), as of early March 2025, installed capacity has already increased by 1 GW compared to the 4.5 GW stated in the "Clean Power 2030 Action Plan." If we also consider projects currently under construction and those already permitted, capacity reaches 20 GW, with another 18 GW of projects announced. However, achieving up to 27 GW of battery capacity by 2030 will depend on many factors, particularly investor and developer confidence in the return on investment (ROI). Reduced confidence could lead to a slowdown in project commissioning, as seen in 2024, with decreased revenues due to frequency market cannibalization. Although declining battery prices will improve the investment case by lowering CAPEX requirements, investors and developers must be aware of the dynamics affecting the available revenue streams for BESS assets.

Fig 3: Cumulative Operational BESS Capacity, Project Pipeline, and National Targets — Source: BloombergNEF, European Energy Storage Repository, Clean Power 2030 Action Plan, RaboResearch 2025

▶ III. Navigating the Diverse and Dynamic UK BESS Revenue Structure

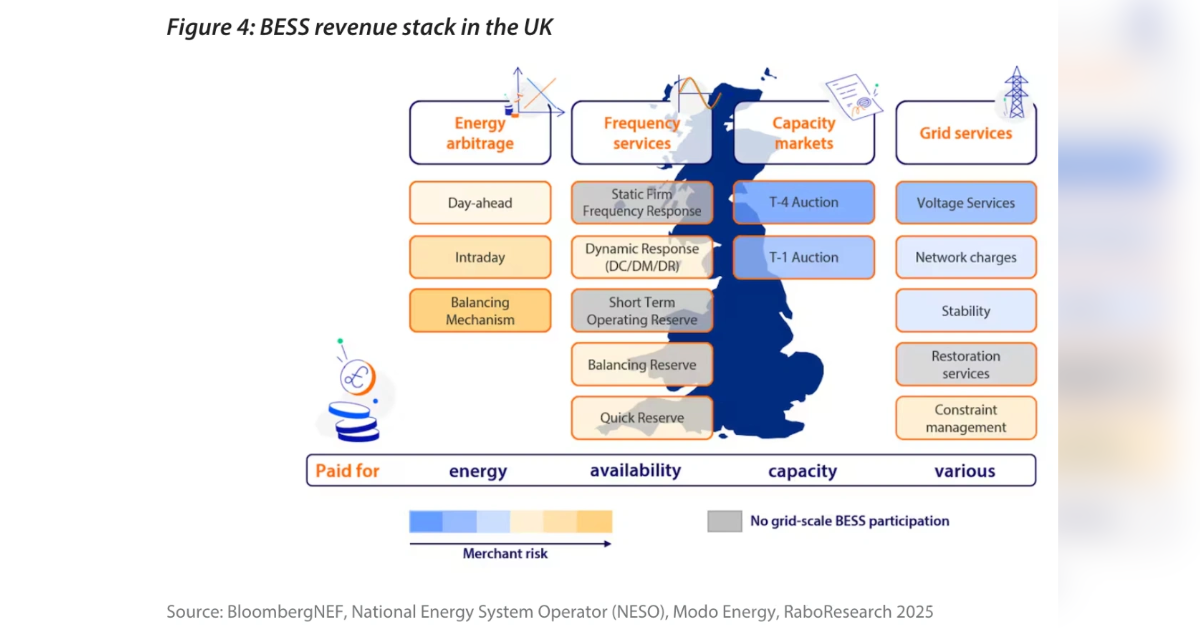

The UK's BESS revenue structure is one of the most diverse in Europe. Most UK wholesale markets and ancillary services allow energy storage to participate as an independent entity, but the dynamics of each revenue stream can change significantly over time, complicating business strategy design.

Want OK! each day? Sign up here!

Fig 4: UK BESS Revenue Structure — Source: BloombergNEF, NESO, Modo Energy, RaboResearch 2025

▶ IV. Shift in Energy Storage from Prioritizing Frequency Response Services to Energy Arbitrage Services

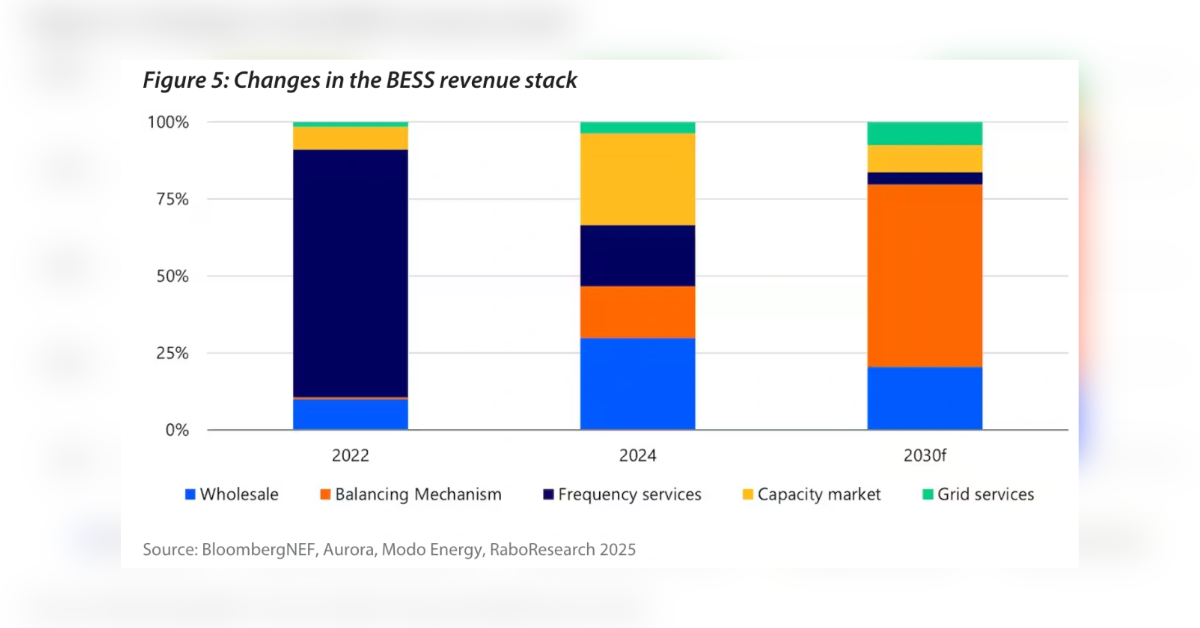

The composition of a typical BESS project's revenue stack is by no means static (see Fig 5); the focus of energy storage has shifted from frequency services to energy arbitrage. Due to market saturation, the share of frequency services in the revenue stack has significantly declined, from 80% in 2022 to just 20% in 2024. Looking ahead to 2030, we expect energy arbitrage to dominate the revenue stack, with most revenue coming from participation in the balancing mechanism.

In the following sections, we will dissect the different revenue streams and their anticipated roles in the future of UK BESS projects.

▶▶ 4.1 Energy Arbitrage in Wholesale Markets

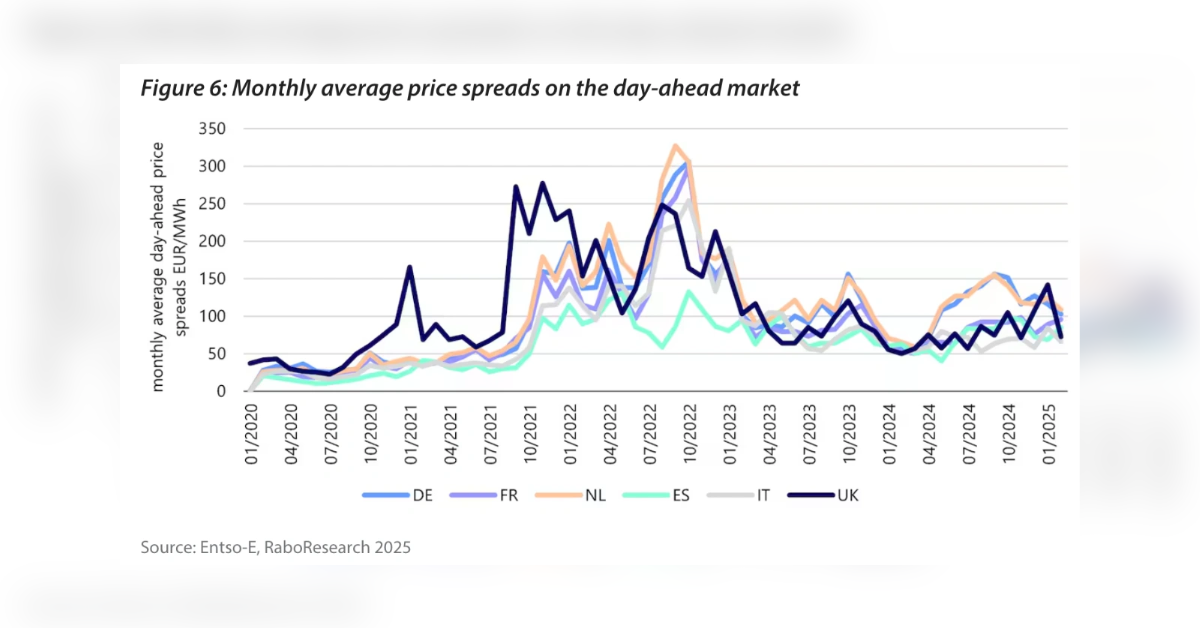

Over the past two years, energy arbitrage has become the most significant revenue stream in wholesale markets. In 2022, it accounted for approximately 8% of the average BESS revenue stack. By 2024, according to Modo Energy data, energy arbitrage accounts for nearly 50% of average project revenue, and this proportion is expected to increase in the coming years. The revenue potential of energy arbitrage largely depends on the electricity generation structure. Due to the UK's smaller solar generation capacity, summer spreads are lower than in Germany and the Netherlands. In winter, spreads tend to increase. Wind power generation leads to lower minimum prices, while rising natural gas prices lead to higher maximum prices.

Looking ahead, the increasing share of wind and especially solar in the UK's electricity mix is likely to facilitate arbitrage opportunities by creating larger price spreads. Similar to Germany and the Netherlands, an oversupply of solar could lead to lower daytime prices. Concurrently, as natural gas remains the primary option for dispatchable generation in the UK, we anticipate continued high prices during peak periods.

Due to the depth of the wholesale market, the potential for market cannibalization of arbitrage revenues is relatively low. Although increased battery capacity may reduce extreme price volatility, the further penetration of renewables combined with the expected unchanged role of gas turbines will sustain arbitrage opportunities. This contrasts with frequency services, where installed battery capacity now exceeds the market's inherent demand, leading to a significant drop in prices.

▶▶ 4.2 Balancing Mechanism and Skip Rates

Another driver for the increased energy arbitrage in the revenue stack is the redesign of the balancing mechanism, which favors batteries. The balancing mechanism can offer higher returns than the wholesale market, as energy is bought or sold at a premium. Currently, even when battery bids and offers are the most competitive available options, they are often skipped. Due to limited data on batteries' available energy capacity, control room engineers often activate traditional balancing mechanism units instead of BESS. This leads to increased system costs and missed revenue for BESS projects. The introduction of the Open Balancing Platform in December 2023 improved BESS participation in the balancing mechanism. This platform allows control room engineers to communicate instructions to balancing mechanism units more effectively, enhancing the participation of smaller units, including batteries. Evidence of this improvement is the reduction in battery skip rates from 90% in 2023 to 75% in 2024. With the deployment of additional measures, such as Grid Code GC0166 in Q3 2025, further improvements in battery skip rates can be expected.

▶▶ 4.3 Frequency Services

Due to market saturation, revenues from frequency services have sharply declined over the past two years. Until 2022, battery operators could command high prices for their services. Starting in 2023, BESS capacity began to exceed the total demand of the frequency market, leading to price drops due to increased competition. According to BloombergNEF data, while a BESS portfolio could typically earn over £110,000 per MW per year from frequency services, this figure dropped to less than £30,000 per MW per year in 2023. In 2024, due to an oversupply of battery capacity, UK frequency prices were already less than half the European average. Consequently, we expect the share of frequency services in the BESS revenue stack to continue to decrease. By 2030, installed BESS capacity may increase sixfold, but the market depth for frequency services will only triple. Therefore, frequency services will continue to be dominated by batteries, but in the long term, they will only constitute a small portion of the BESS revenue stack.

▶▶ 4.4 Capacity Market

Unlike energy arbitrage and frequency services, the capacity market provides a stable revenue stream. The UK organizes two types of auctions: T-4 (four years ahead of delivery) and T-1 (one year ahead of delivery). These auctions are open to existing and planned generation and storage facilities. T-4 auctions provide the majority of capacity market volume and offer contracts for up to 15 years. Securing a T-4 capacity market contract can provide a stable revenue stream for a BESS project, even before it is built. However, for existing projects, a four-year delay in revenue can present significant challenges. In recent capacity market auctions, the National Energy System Operator (NESO) has contracted with many BESS projects to increase battery capacity on the grid. Concurrently, revenues from frequency services have significantly declined. As a result, some operational storage projects have yielded disappointing returns, while the deployment of others has been delayed. Capacity market contract prices have varied greatly in recent years, partly due to differing participation rates of BESS projects. Price dynamics are also influenced by the generation costs of competing technologies, primarily gas-fired generation. For the coming years, Modo Energy expects capacity market revenue to account for 10% to 20% of BESS revenue.

▶▶ 4.5 Grid Services

Grid services typically play a smaller role in a BESS project's revenue stack but can provide additional low-risk income to strengthen the investment case for energy storage businesses. Remuneration and bidding processes vary by service. Recently, NESO-managed grid services have undergone several reforms favorable to BESS. Voltage, stability, and restoration (black start) services were traditionally procured from thermal generators. Due to their physical characteristics, these generators can produce and absorb reactive power and provide inertia. However, although batteries are asynchronous, their PV inverter technology can generate reactive power and provide virtual inertia. NESO is now procuring these services from batteries. In 2022, five BESS projects secured contracts in tenders for providing stability services. One of these projects, Blackhillock in Scotland, came online in March 2025, making it the world's first BESS project to provide stability services. In late 2024, three BESS projects secured ten-year voltage contracts. Restoration service contracts have not yet been awarded to BESS projects, but batteries have been included in NESO's feasibility study for new black start technologies. Transmission and distribution network charges can be divided into two types: Transmission Network Use of System (TNUoS) and Distribution Use of System (DUoS), referring to the transmission and distribution networks, respectively. Network charges are based on the storage location. Storage projects located close to load demand, such as in Southern England, are paid network charges or compensated, while battery projects far from load demand, such as in Scotland and Wales, must pay fees. Another location-based service available for BESS is constraint management. Battery projects located in Eastern England and Scotland can compete in tenders to be on standby in the event of a transmission fault. So far, only one battery project, Wishaw, has secured a constraint management contract, and the revenue potential of this service is not yet fully clear.

▶ V. Other Developments in the UK BESS Energy Storage Market Landscape

▶▶ 5.1 Tolling Agreements (Fixed-Rate Agreements)

The decline in merchant revenues in 2023 and 2024 has increased BESS operators' interest in contractual revenues, such as tolling and floor price agreements. In 2024, BESS asset manager Gresham House and optimizer Octopus Energy signed the UK's first BESS tolling agreement. This agreement allows Octopus Energy to operate 568 MW/920 MWh of battery capacity for two years. In return, Gresham House will receive £57,000 per MW per year, exceeding the average BESS revenue in 2024. Whether fixed-rate agreements will become the norm for BESS projects will depend on the returns and stability offered by merchant revenue streams.

▶▶ 5.2 Bigger, Better, Longer

UK BESS projects are becoming increasingly larger in terms of rated power and system duration. At the end of 2024, the largest BESS project was 100 MW. 2025 will see 300 MW and larger batteries come online, while 1 GW batteries are entering the project pipeline, with plans for development by 2027. The rapid decrease in energy storage system prices has led to durations increasing from 1h to 2h becoming standard. Some announced projects even have durations of up to six hours.

▶▶ 5.3 Location, Location, Location...

Due to grid constraints, revenues are becoming increasingly location-dependent. According to Modo, battery projects in Northern Scotland and Southeast England have above-average revenues, while those in the Midlands and Southwest England have below-average revenues. The primary reason for this disparity is that the balancing mechanism is location-based. If the UK adopts zonal pricing (which the UK government is considering), the importance of project location will further increase. Different price zones could lead one area to offer more attractive wholesale price spreads than others. The impact of generation mix, demand, and interconnections on electricity prices should be evaluated at the local level in such a scenario.

▶▶ 5.4 Co-located Projects (Solar/Wind plus Storage)

Energy storage is expected to play an increasingly important role in co-located projects with wind and especially solar power generation. Placing batteries at the same site as intermittent generation can optimize grid use and manage curtailment risk, for example, by improving Power Purchase Agreements (PPAs). However, the business case for co-located BESS differs from standalone BESS and requires new expertise. Nevertheless, large co-located projects such as Ørsted's Hornsea wind and storage project (300MW/600MWh) are in the project pipeline.

▶▶ 5.5 New Potential Revenue Streams Will Become Available

The UK electricity system is undergoing reform, and many new grid services under NESO contracts will be open to BESS. These include additional fast reserves for non-balancing mechanism registered batteries, slow reserves, stacking possibilities for dynamic response and reserves, static restoration products, location-based procurement of dynamic response and reserves, and additional stability, voltage, and constraint markets.

▶ VI. What Can BESS Investors Expect in the Future?

Following a period of success for UK BESS operators, traditional revenues are declining, primarily due to the saturation of the frequency market. As the trading volume in the frequency market will only slightly increase compared to BESS capacity, high revenue streams from frequency services are unlikely to return. Therefore, BESS investors must carefully adjust their business models to adapt to this new reality by choosing merchant and/or contractual revenue streams. On the merchant side, arbitrage opportunities are expected to increase due to the rapid growth of renewable energy and the evolution of the balancing mechanism. However, it is crucial to stay informed about the possibility of zonal pricing, which could lead to significant differences in arbitrage opportunities between regions. On the contractual side, the capacity market will continue to provide guaranteed income. Floor price and Tolling Agreement fixed-rate agreements may become more common options for BESS projects to secure revenue, while other contractual revenues, such as PPAs, may also become available for BESS projects. Declining energy storage system costs will reduce capital expenditure for new projects and for expanding or replacing existing ones. Despite the uncertainties, government plans and market demand indicate significant long-term potential for investors.