NEWS

NEWSNancy Pelosi's Wealth Soars: Report Reveals Eye-Popping $42.5 Million Boost in 2024

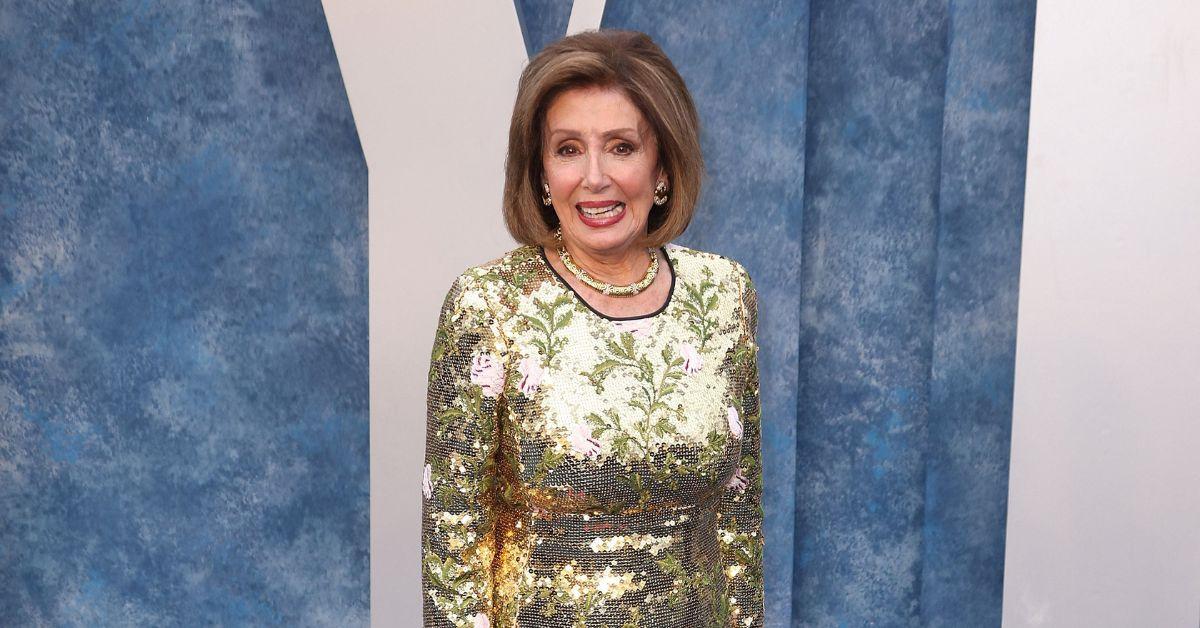

Nancy Pelosi's net worth rose by $42.5 million in 2024, fueling a debate over lawmakers' wealth.

July 12 2025, Published 11:00 a.m. ET

Rep. Nancy Pelosi (D-California) is proving that she means business when it comes to investing.

In a staggering financial turn, the former House Speaker and her venture capitalist husband, Paul Pelosi, added between $7.8 million and $42.5 million to their net worth in 2024.

This leap places their estimated combined wealth at a jaw-dropping $413 million, according to recent financial disclosures.

This significant increase marks a substantial rise from 2023, when the couple's net worth approached $370 million. However, calculating Nancy's exact worth remains tricky, as lawmakers only need to disclose ranges.

Nancy Pelosi is a Democratic congresswoman — and the first woman to serve as House Speaker.

Market research firm Quiver Quantitative estimates the couple's worth at $257 million for 2024, reflecting a $26 million increase from the previous year. Nevertheless, their numerous ventures — inclusive of a Napa Valley winery, a political data consulting firm and a stake in a Bay Area Italian restaurant — suggest that actual net worth could be far greater.

Paul and Nancy Pelosi have been married since 1963.

Much of the couple's fortune stems from a robust stock portfolio, with Paul executing timely trades under his name. Notably, they sold 5,000 shares of Microsoft stock valued at approximately $2.2 million in July, just months before the FTC launched an antitrust investigation into the tech giant.

In addition, they disposed of 2,000 shares of Visa worth around $525,000, only weeks prior to the DOJ asserting a monopoly lawsuit against the company.

NVIDIA was not their only venture tied to artificial intelligence this year. In February, they invested between $600,000 and $1.25 million for a call option on California-based cybersecurity firm Palo Alto Networks, coinciding with a White House briefing about a serious national security threat from Russia. Following this investment, shares surged nearly 20 percent.

Nancy and Paul Pelosi's tech stock trades have sparked concerns.

- What Is Kellyanne Conway's Net Worth? How She Became One of the Richest Politicians Under Donald Trump's Reign

- Major Score: Poshmark Board Member Serena Williams Is $18 Million Richer After Stock Soars During IPO

- Nancy Pelosi Stands by Her Scathing Description of 'Vile' Donald Trump: 'I Could've Done Much Worse'

Want OK! each day? Sign up here!

The option allowed them to acquire 14,000 shares of Palo Alto in December at a $100 strike price — significantly lower than its trading value. With the company excelling in earnings, this investment now sits at an impressive $2.8 million.

Overall, their investment portfolio reaped an estimated 54 percent return in 2024 — more than double the S&P 500's 25 percent gain and outpacing all large hedge funds, according to Bloomberg's end-of-year figures.

These impressive gains come amid mounting calls to prohibit Congress members from trading individual stocks, with critics arguing that lawmakers hold market-moving information not available to the public. While Nancy has previously dismissed calls for a ban, insisting on the importance of a free market, her stance has softened amid increasing scrutiny.

In May, she stated, "If they do, they do," when asked about a potential trading ban.

'Speaker Pelosi does not own any stocks,' her spokesperson said.

A spokesperson for Pelosi affirmed, "Speaker Pelosi does not own any stocks, and she has no prior knowledge or subsequent involvement in any transactions."

As 2025 arrives, the couple is already starting strong. In January, they secured call options for an emerging artificial intelligence health company, Tempus AI, which recently struck a $200 million deal with AstraZeneca, doubling its stock price.

Additionally, they bought call options for energy company Vistra, whose stock price surged last month following a $1.9 billion deal to acquire natural gas facilities nationwide, driven by increasing U.S. power demand.