NEWS

NEWSTop Liability Pitfalls California Small Businesses Should Avoid in 2025

July 30 2025, Published 1:02 a.m. ET

I was recently speaking with a business owner in San Diego—let’s call her Maria. She runs a thriving specialty food distribution company with 22 employees and a modest fleet of delivery vans. One Friday morning, one of her drivers stopped for coffee on the way to a client site. A routine errand turned into a six-figure problem when he rear-ended another car, injuring two passengers.

What shocked Maria most wasn’t the accident—it was the liability. She discovered that her commercial auto coverage didn’t fully account for personal detours during company business. The plaintiff’s attorneys were aggressive, the claim ballooned, and she faced the prospect of dipping into the company’s reserves.

Unfortunately, Maria’s story isn’t rare. California’s liability landscape is shifting quickly, and small businesses are squarely in the crosshairs. In 2025, the stakes have never been higher.

Why Liability Risks Are Rising in California

The numbers tell a sobering story. California recorded more than 160,000 crashes in 2024, with injuries topping 270,000, according to state transportation data. Employers shoulder a surprising amount of this burden: roughly 40% of U.S. vehicle accidents involve employees driving for work.

On top of that, California’s new SB 1107 law, effective January 1, 2025, has doubled the state’s minimum auto liability limits:

- Bodily injury coverage increased from $15,000 to $30,000 per person.

- The per-accident limit climbed from $30,000 to $60,000.

- Property damage coverage rose from $5,000 to $15,000.

While these changes aim to better protect victims, they also expose underinsured businesses to potentially devastating losses. Insurance premiums, already up 23% over inflation in the last two years, are set to rise further as carriers adjust to the new thresholds.

The Six Liability Pitfalls Small Businesses Can’t Afford to Ignore

1. Misinterpreting the “Course and Scope” of Employment

California courts continue to broaden the circumstances under which employers are held liable for employees’ actions behind the wheel. In the 2025 Moradi v. Marsh decision, a commuting employee who stopped at the pharmacy for a personal errand was still deemed to be acting in the “course and scope” of employment.

This means that even seemingly harmless detours could trigger employer liability. If your policy doesn’t clearly define business versus personal use, your company could be left exposed.

2. Negligent Hiring and Entrustment

Too often, companies allow employees to drive without adequately screening their records. Plaintiffs’ attorneys are increasingly pursuing “direct negligence” claims—arguing that businesses failed to properly hire, train, or supervise drivers.

Consider the case of a Bay Area marketing agency that hired a contractor without running a motor vehicle report. When the contractor caused a serious crash, it was revealed that his license had been suspended twice. The agency faced a seven-figure settlement.

3. Insurance Gaps That Don’t Cover Real-World Scenarios

Many small businesses operate with commercial auto coverage that doesn’t account for the complexities of modern business. Do your employees use their personal cars for client visits? Do you borrow or rent vehicles occasionally?

If you don’t have Hired and Non-Owned Auto (HNOA) coverage, you’re likely underinsured. The cost of one serious accident could easily exceed traditional policy limits—especially under SB 1107’s higher thresholds.

4. Weak Driver Safety Policies

In California, distracted driving contributes to around 8–10% of crashes, while speeding is a factor in roughly 32% of traffic fatalities and alcohol impairment accounts for about 30% of fatal crashes. Yet, many small businesses have no formal policies addressing mobile phone use, seat belt compliance, or drug and alcohol testing.

Without documented safety standards, you risk being portrayed as negligent in court. Even a simple hands-free policy can significantly reduce both accidents and liability.

5. Poor Incident Response and Documentation

Accidents are chaotic, but how you respond can shape the outcome. Delayed reporting, incomplete witness statements, and missing photographs can all weaken your defense.

One Los Angeles construction firm learned this the hard way when a supervisor failed to notify the company of a minor crash until weeks later. By then, evidence had vanished, and the company had little recourse when the claimant’s injuries escalated.

6. Reputation and ESG Risks

In today’s digital world, news travels fast. An employee-caused crash can quickly go viral, damaging your brand’s credibility. ESG-conscious clients and investors are increasingly asking how companies monitor driver behavior and ensure public safety.

Neglecting this reputational dimension can cost you contracts and talent, even if you win the lawsuit.

The Hidden Costs That Erode Your Bottom Line

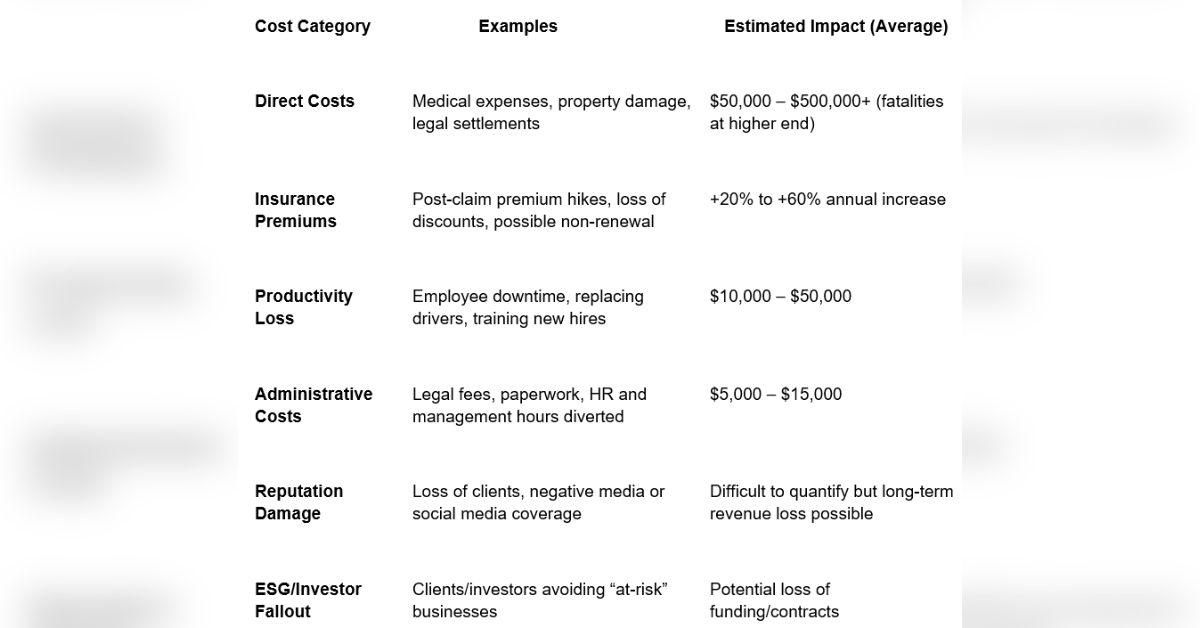

Settlements and verdicts are just the tip of the iceberg. After a serious incident, you could face:

Hidden Costs of an Employee Vehicle Accident

Want OK! each day? Sign up here!

- Insurance premium hikes or outright non-renewal if you have multiple claims.

- Operational disruption, as key employees are sidelined and clients face delays.

- Recruitment challenges, since high-risk employers are less attractive to top talent.

Research from the Network of Employers for Traffic Safety (NETS) shows that the average employer cost of a crash involving injuries exceeds $74,000, while a fatal accident can surpass $500,000. Additional data from injury lawyers in California highlights how these hidden costs compound over time.

How Small Businesses Can Protect Themselves

1. Create a Clear Driving Policy

Spell out what constitutes business use, when employees may use personal vehicles, and how to report incidents. Require a signed acknowledgment.

2. Screen and Train Drivers

Run motor vehicle reports at hire and annually. Provide refresher courses on defensive driving and distracted driving.

3. Invest in HNOA Coverage and Umbrella Policies

Your broker should review your coverage annually to ensure it aligns with your risk profile and California’s evolving liability laws.

4. Leverage Telematics

Telematics tools that monitor speed, braking, and phone use can not only reduce accidents but also demonstrate due diligence to insurers and courts.

5. Build a Strong Incident Response Process

Create a checklist for employees to follow at the scene, including taking photos, gathering witness statements, and notifying the company immediately.

The Legal Landscape Is Evolving

In addition to Moradi v. Marsh and SB 1107, courts are scrutinizing independent contractor classifications more closely. Misclassification can backfire if you try to distance yourself from a driver’s actions.

Small businesses must also prepare for more aggressive plaintiffs’ tactics, as accident lawyers pursue both vicarious liability and direct negligence claims in parallel.

A Final Word for California Business Owners

Maria—the food distributor from my opening story—has since rewritten her driving policy, added HNOA coverage, and installed telematics in her vans. She now sleeps better knowing she’s taken steps to protect her business.

The truth is, you don’t have to navigate this landscape alone. The key is proactive planning. By tightening your policies, closing insurance gaps, and fostering a culture of safety, you can position your organization for long-term growth without being blindsided by avoidable liability.

Now is the time to act.