NEWS

NEWSTriller and Nasdaq Listed AGBA Group: A Strategic Merger Revealing a $4 Billion Digital Powerhouse

May 7 2024, Published 4:33 a.m. ET

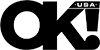

Triller, primarily perceived as a social media platform competing against TikTok, significantly exceeds this narrow view. The upcoming $4 billion merger with AGBA, a NASDAQ-listed ecommerce behemoth, emphasizes Triller's multifaceted capabilities and robust valuation which starkly surpasses the sum agreed upon in the merger, even before considering its role in the social media landscape.

Triller's Diverse Digital Portfolio: A Closer Examination

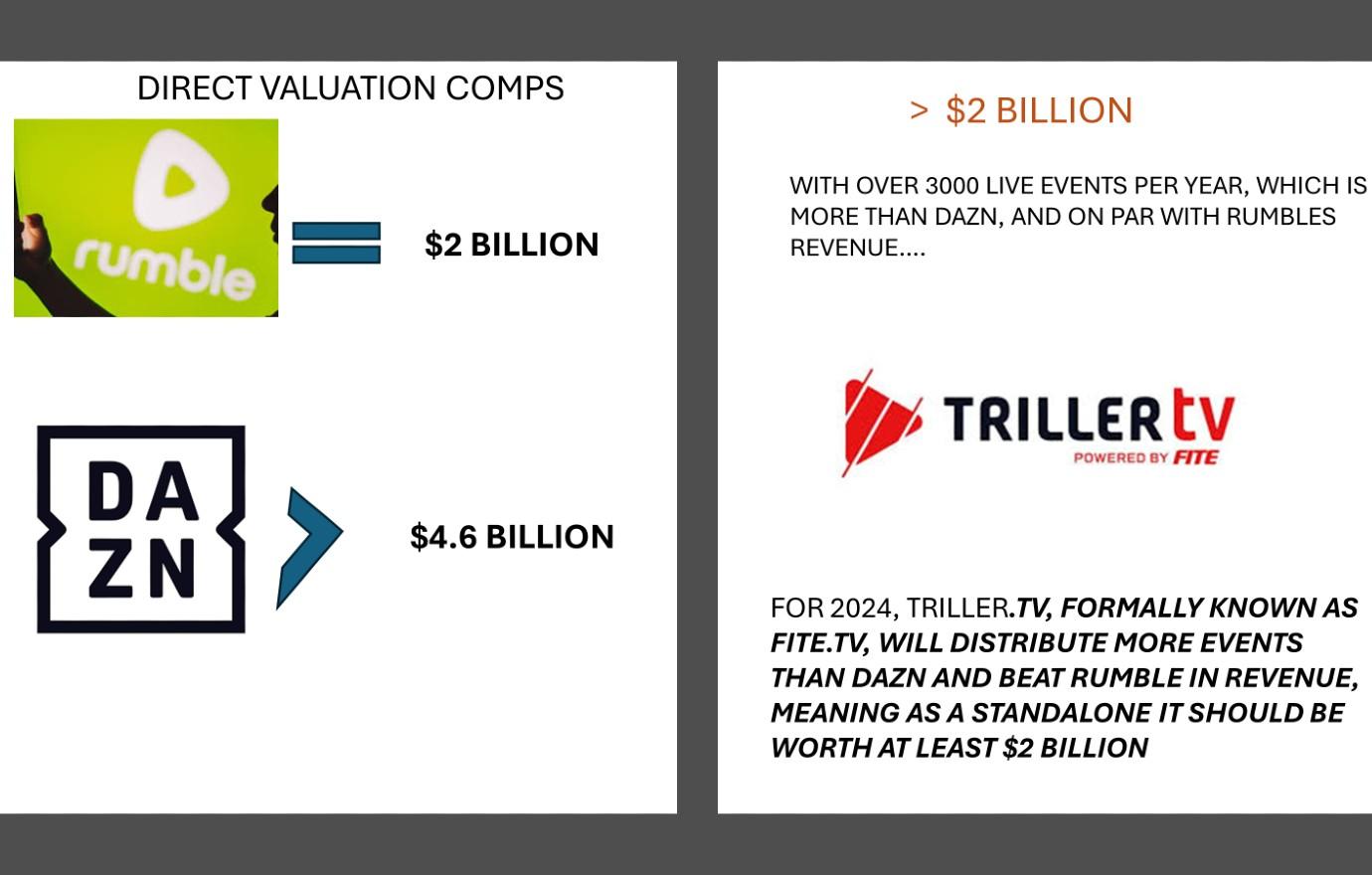

Triller.TV: A Digital Broadcasting Powerhouse

Born from the acquisition of Fite.tv, Triller.TV has transcended its origins to become a leader in digital broadcasting, particularly within the combat sports arena. It now penetrates 7 million households and showcases over 3,000 events annually. With its expansion into lifestyle and entertainment, Triller.TV not only rivals but occasionally surpasses platforms like Rumble, which boasts a near $2 billion market cap. Considering Triller.TV’s diverse content and substantial reach, its standalone valuation might reasonably hover between $1.5 and $2.5 billion.

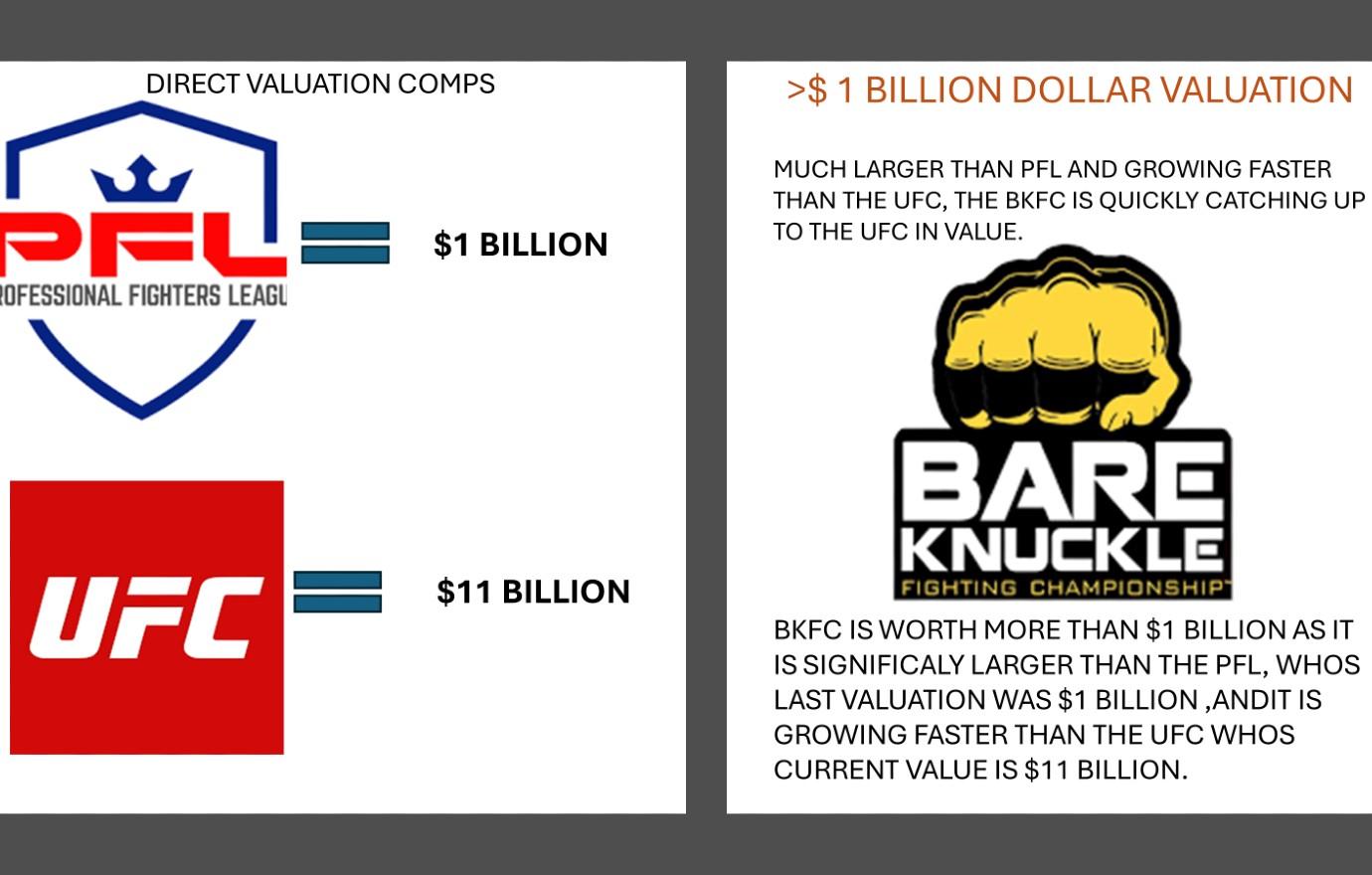

BKFC: Reshaping Combat Sports

Under Triller's stewardship, the Bare Knuckle Fighting Championship (BKFC) has exploded in popularity, challenging traditional giants like the UFC. Notably, BKFC's events attract over 10 million viewers, often surpassing UFC's viewership. This high-profile segment, especially with celebrity endorsements and partnerships such as with Conor McGregor, makes it one of the most recognized and valuable names in combat sports. While growing faster than the UFC and often surpassing its viewership on events, the UFC has been around a lot longer and has built a very solid Revenue and earnings base. BKC has, however, far surpassed both the PFL and Bellator who’s private market caps are known to be in excess of 1 Billion. Using this data, to peg a valuation on BKFC as a standalone would suggest it is north of $1 Billion but worth less than the UFC’s current $11 Billion market cap. With unprecedented growth and a loyal fanbase BKFC is sure to continue to grow at a rapid pace.

Amplify.AI: Pioneering Conversational AI

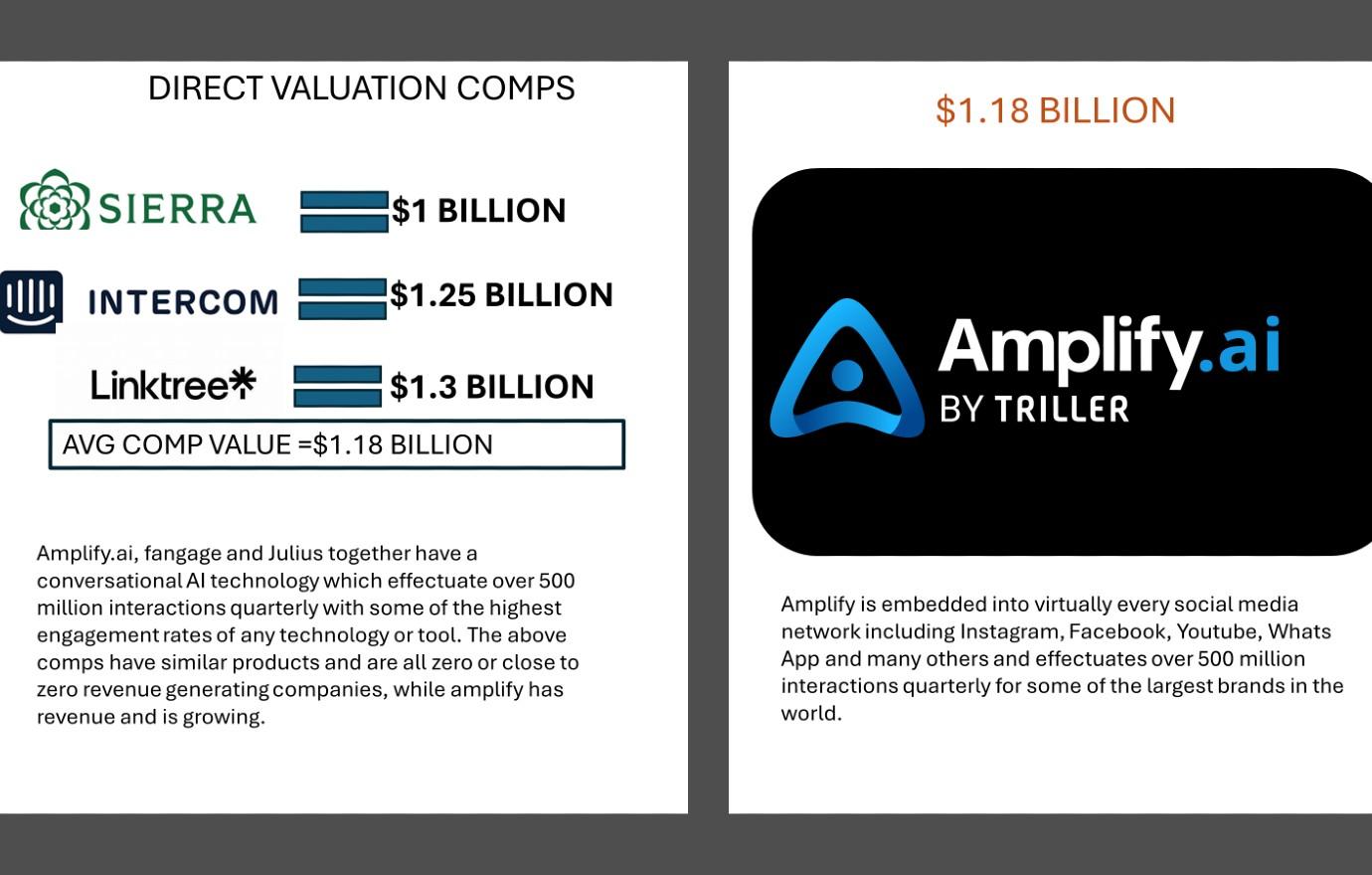

Amplify.AI leverages AI to enhance user engagement across major social platforms such as Instagram, WhatsApp, YouTube, Snapchat and virtually every other social media platform. Powering over 500 million interactions quarterly, Amplify is a quickly growing product suite embedded within most social networks and becoming a resource many of the worlds largest companies have come to rely upon to power their connectivity with users or potential uers across social media in general. . Although hard to comp, it has been around since 2016 and been used by some of the largest brands and political campaigns such that AI is not just a “buzzword”. It is a trusted platform by most other social media networks and much of the fortune 500 making it one of the top AI companies in the space today. There are some public market comps for ad tech conversional AI companies whos breadth and depth is no where near that of Amplify whos valuations far exceed $ 1billion.

Want OK! each day? Sign up here!

Julius and Fangage: Leading the Influencer Marketing Revolution

Julius, a platform within Triller's ecosystem, connects 2.2 million brands with 25,000 influencers, while Fangage focuses on monetizing fan interactions. The recent introduction of TrillerOne amalgamates these platforms, providing a comprehensive influencer marketing solution. With the burgeoning demand for influencer engagement, the combined ventures could be valued at around $1 billion, mirroring valuations of similar venture-backed entities, comping to private companies who .

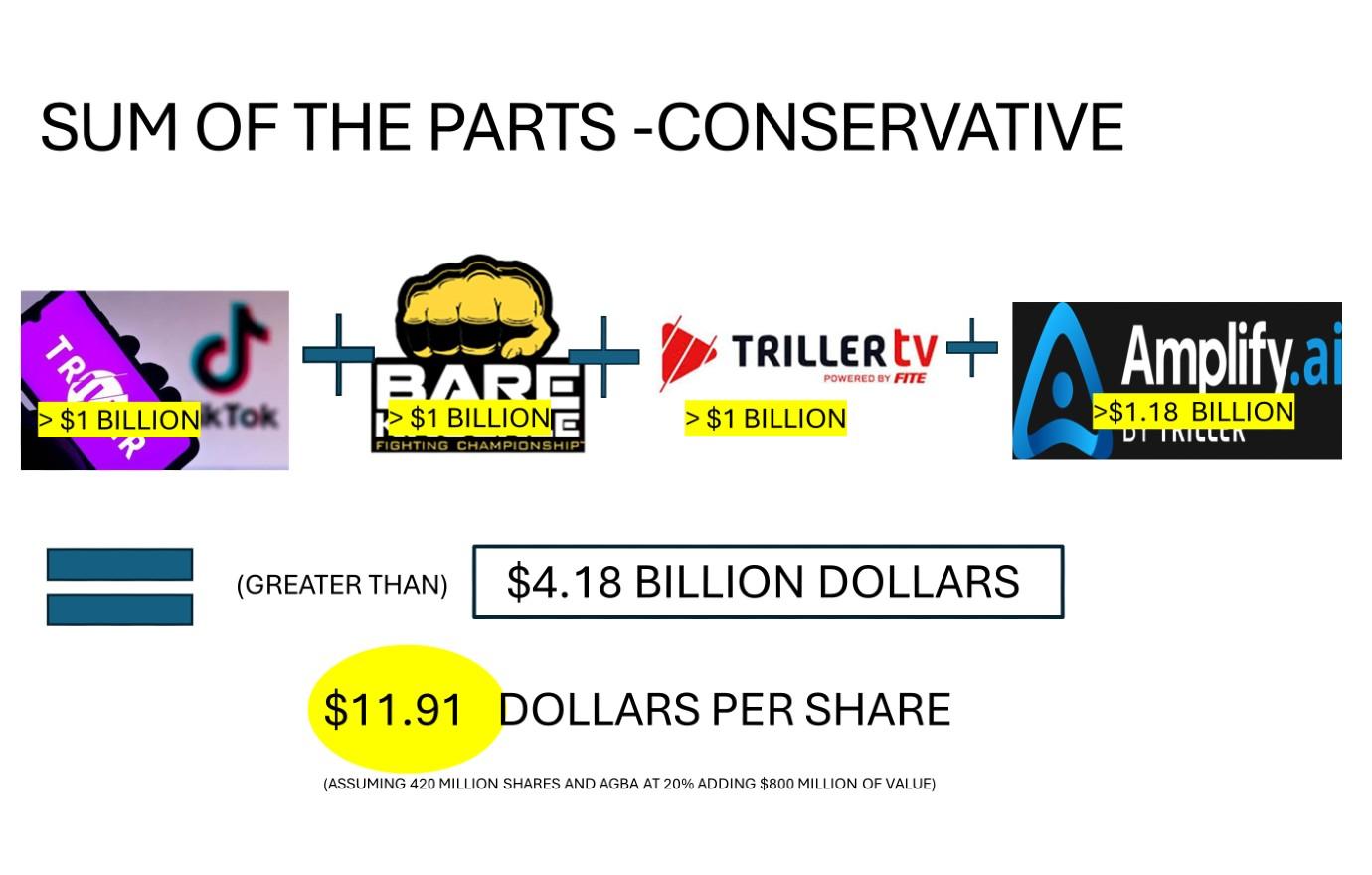

Comprehensive Valuation: Sum of the Parts Analysis

Breaking down Triller's components provides a clearer view of its inherent worth, apart from its social media functionality:

- Triller.TV: $1.5-2.5 billion based on its broad content and substantial reach.

- BKFC: North of $1 billion.

- Amplify.AI: $2-3 billion, reflecting its technological innovation and extensive application.

- Julius and Fangage: Although there are few, if any, public market comps there are private influencer market places each who do one portion of wha Triller One does. Most of these entities valuations are north of $500 million with a majority over $ 1billion. Given that Triller’s shareholders and partners include a large portion of the worlds top 100 influencers, many of whom actively participate in Triller, the TrillerOne ecosystem should be at the higher end of the industry comps.

Sum of The Parts: Before adding in the value of the Triller App itself, it is not a far stretch to see hwo Triller’s valuation ranges between $5.5 and $7.5 billion, markedly higher than the merger valuation, affirming its substantial underestimation in the merger metrics. Based on regulatory filings to date it seems that if AGBA holders are to receive 20% of the total post merger consideration that AGBA shareprice should be at least $10 per share, before taking into account the strategic value of Triller being what looks to be the defacto tiktok replacement. Of course there is always some built in transaction risk discount, but that too,i n this case is unique. Most public mergers require a shareholder vote 30 days after an approval by the SEC of an S4, which can be a timely process. In this case since AGBA is 90 percent owned by one group it has already provided effective shareholder approval, and rather than filing an S4 it is only required to file a much simpler document referred to as an Information Statement. This both reduces the risk of the merger not occurring and speeds up the process.

Deep Pockets

Public records indicate that AGBA is ultimately owned and controlled by one of the worlds richest men, Richard and Daniel Tsai, whom together own many strategic assets which could supercharge Triller overnight, including large stakes in Taiwan Mobile, Taiwan motors, Fubon Financial and Fubon Life, and most important Momo. Momo is taiwans largest ecommerce portal often referred to as a super app and one of the fastest growing fintec companies in the world. The strategic nature of the Tsai’s investments and involvement in other companies such as Momo and other technology, ecommerce and fintek companies paired with what seems to be incredibly deep pockets make this merger one of the more anticipated offerings of the year.