NEWS

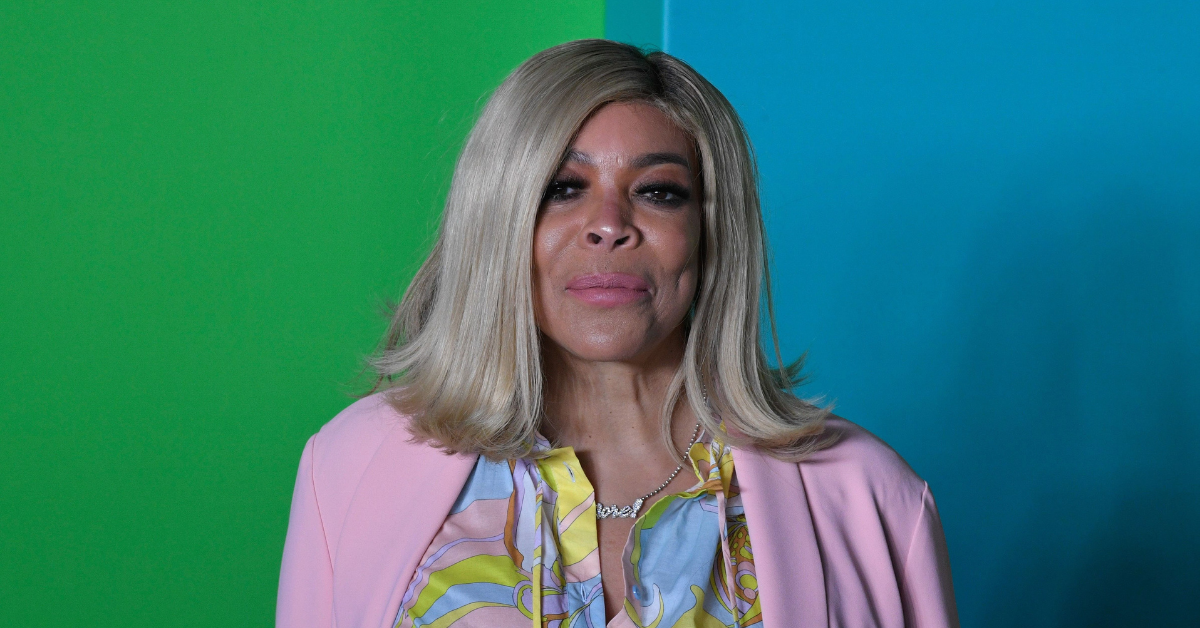

NEWSWendy Williams Dubs Ex Financial Advisor A 'Disgruntled' Former Employee After Claiming Ailing Host Was 'Of Unsound Mind'

Feb. 14 2022, Published 10:38 a.m. ET

Wendy Williams demanded access to her bank accounts last week while taking a jab at one of her former employees who deemed her unfit to take care of her own assets.

After Wells Fargo froze her bank accounts and claimed she needed a guardianship earlier this month, the 57-year-old reportedly filed an affidavit in New York Supreme Court on Friday, February 11.

The affidavit was in support of Williams' attorney Celeste N. McCaw’s request for a temporary restraining order against the bank, per Page Six. In the legal filing, Williams dubbed the former financial advisor who shared her concern about the ailing talk show host's wellbeing a "disgruntled" former employee.

Wells Fargo claimed in court filings that they decided to freeze the Ask Wendy author's accounts because financial adviser Lori Schiller insisted she was “of unsound mind," a claim Williams profusely shot down. The bank is currently trying to determine whether Williams is being exploited by those around her.

In her affidavit, the troubled TV personality — who hasn't been back to The Wendy Williams Show since July 2021 due to ongoing health issues — said she fired Schiller “as a result of her improper conduct in relation to my accounts,” it was reported.

"It appears that Schiller was and is disgruntled by this decision for a potential change in direction, and it saddens me that [Wells Fargo] and I have not been able to resolve this controversy amicably," she reportedly continued.

- Wendy Williams Obtains Power Of Attorney After Claiming Wells Fargo Froze Her Out Of Her Bank Accounts

- Wells Fargo Claims Wendy Williams Is Being Financially 'Exploited' After Freezing Talk Show Host's Accounts

- Wells Fargo Offers To Pay Wendy Williams Bills But Still Refuses To Give Her Access To Her Frozen Bank Accounts: Report

Want OK! each day? Sign up here!

Williams claimed in the docs that Wells Fargo's hold on her accounts for weeks caused “imminent and irreparable financial damage." Despite visiting "various Wells Fargo branches in the South Florida area in an effort to resolve this matter outside of the courtroom," the bank has "repeatedly denied my requests to access my financial assets," she claimed in court docs.

In light of the situation, Williams insisted she has “defaulted … on several billing and financial obligations, including, but not limited to, mortgage payments and employee payroll” as a result of being unable to retrieve money from her bank."

While Schiller has yet to address the claims, a Wells Fargo rep maintained on Sunday, February 13, that the company's "priority is the financial well-being of Ms. Williams and the preservation of her privacy," reportedly adding: "As we have expressed to the court, Wells Fargo is open to working with Ms. Williams’ counsel to release funds directly to her creditors for bills historically and regularly paid from her accounts."

Williams' statement came on the heels of Wells Fargo’s attorney David H. Pikus declaring to Judge Arlene Bluth that the bank was “concerned about [Williams’] situation," it was reported. Pikus asked that the court "appoint a temporary guardian or evaluator to … ensure that [Williams’] affairs are being properly handled."

According to Pikus, the bank "has strong reason to believe" Williams is an "incapacitated person" who is a “victim of undue influence and financial exploitation."

Meanwhile, a spokesperson for the bank also previously denied "any allegations of improper actions with respect to Ms. Williams’ accounts."

The judge has yet to rule on the restraining order request.